Introduction to Lendela

![Lendela Review [2025]](https://techwithaisha.com/wp-content/uploads/2025/09/WhatsApp-Image-2025-09-13-at-10.22.44-AM-1024x465.jpeg)

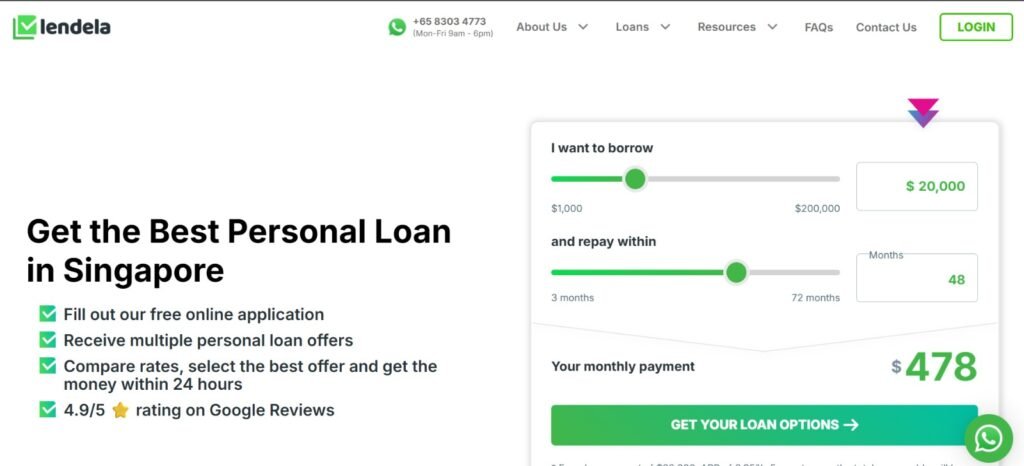

Lendela Review is an online loan comparison platform designed to help borrowers find the best financing options quickly and conveniently. Instead of applying to multiple banks or lenders individually, Lendela allows users to compare different loan offers in one place, saving both time and effort.

As a loan comparison platform, Lendela works by collecting essential information from users, such as loan amount, repayment period, and personal details, and then matching them with lenders who meet their criteria. The platform provides transparency on interest rates, fees, and repayment terms, making it easier for users to make informed decisions.

The main advantage of using Lendela Review is its efficiency: borrowers submit a single application and receive multiple tailored offers, which they can compare side by side. This approach reduces the hassle of contacting multiple financial institutions and helps users identify the most suitable loan for their financial situation.

In short, Lendela Review simplifies the borrowing process by acting as a centralized hub for loan comparisons, ensuring users can access competitive offers without unnecessary paperwork or lengthy bank visits.

How Lendela Works

Using Lendela Review is designed to be simple, fast, and convenient, even for first-time borrowers. The platform streamlines the loan application and comparison process so users can make informed decisions without visiting multiple banks or financial institutions.

Step-by-Step Process

- Apply Once

Users start by filling out a single online application on the Lendela platform. This includes basic personal details, desired loan amount, repayment period, and other relevant financial information. - Get Matched with Lenders

Once the application is submitted, Lendela’s system matches the user with multiple lenders who meet their criteria. This ensures that borrowers only receive offers they are eligible for, reducing unnecessary rejections. - Compare Offers

The platform displays all matched loan offers side by side. Users can compare interest rates, repayment terms, fees, and other important conditions to identify the most suitable option. - Choose the Best Loan

After reviewing all available offers, users select the loan that fits their needs. Lendela then facilitates the connection with the chosen lender to complete the application process.

Eligibility Requirements

To use Lendela Review, borrowers generally need to meet basic eligibility criteria set by the platform and its partner lenders. Typical requirements include:

- Being of legal age (usually 18 years or older)

- Having a valid government-issued ID

- Proof of income or employment

- A bank account for receiving the loan funds

Meeting these criteria ensures that users can access the most relevant loan offers and increases the likelihood of approval.

In short, Lendela Review simplifies borrowing by combining multiple lender offers into one easy-to-use platform, allowing users to apply once, compare efficiently, and choose the best loan for their financial situation.

Loan Types Offered

One of the key advantages of using Lendela is the variety of loan options available. The platform allows borrowers to compare different types of credit to find the one that best fits their financial needs.

Personal Loans

Personal loans are the most common type of financing found on Lendela. These loans can be used for various purposes such as home renovations, medical expenses, debt consolidation, or other personal projects. Lendela lets users compare interest rates, repayment terms, and fees from multiple lenders to find a personal loan that suits their budget and timeline.

Business Loans (If Applicable)

Some Lendela partner lenders also offer business loans. These are designed for entrepreneurs, startups, or established businesses looking for working capital, equipment financing, or expansion funds. The platform helps business owners compare offers efficiently, ensuring that they can secure funding with favorable terms.

Other Credit Options

In addition to personal and business loans, Lendela may provide access to other credit options depending on the user’s profile and the partner lenders’ offerings. These could include:

- Short-term loans

- Lines of credit

- Specialized financing options for students or specific industries

By offering multiple types of credit, Lendela ensures that users can explore all available options before committing to a loan, increasing the likelihood of finding the most suitable and affordable solution.

Interest Rates & Loan Terms

Understanding interest rates and loan terms is crucial when comparing financial offers. The Lendela platform provides users with clear information on both, helping borrowers make informed decisions without hidden surprises.

Typical Ranges Offered

Interest rates on loans offered through Lendela vary depending on the lender, loan type, and borrower profile. On average:

- Personal Loans: Rates typically range from 6% to 20% per annum.

- Business Loans: Rates generally range from 8% to 25%, depending on business size and risk assessment.

- Other Credit Options: Short-term loans or specialized credit may carry higher rates due to shorter repayment periods or specialized terms.

Loan terms also differ depending on the type of financing. Personal loans generally have repayment periods of 12–60 months, while business loans can vary from 6 months up to several years. Lendela allows users to compare these terms side by side so they can find a loan that balances monthly payments with total interest cost.

Factors Affecting Approval and Rates

Several factors influence both the interest rate offered and the likelihood of loan approval through Lendela:

- Credit Score: Higher scores typically result in lower interest rates and faster approval.

- Income and Employment Status: Stable income increases eligibility and may lead to better rates.

- Loan Amount and Term: Larger loans or longer repayment periods can impact the interest rate.

- Debt-to-Income Ratio: Lenders evaluate your existing financial obligations to assess risk.

By providing transparency on rates and terms, Lendela helps borrowers make informed choices and select the most suitable loan based on their financial situation.

Pros & Cons of Using Lendela

Like any financial platform, Lendela has both advantages and potential limitations. Understanding these will help borrowers decide if it is the right tool for comparing and securing loans.

Pros (Strengths)

- Convenient Comparison: Users can apply once and compare multiple loan offers in one place, saving time and effort.

- Transparency: Lendela provides clear information on interest rates, fees, and repayment terms, helping users make informed decisions.

- Wide Range of Lenders: The platform partners with multiple banks and financial institutions, increasing the chances of finding competitive offers.

- Fast Matching Process: After submitting an application, borrowers are quickly matched with relevant lenders, speeding up approval.

- User-Friendly Platform: The website and mobile interface are designed to be easy to navigate, even for first-time borrowers.

Cons (Potential Downsides)

- Limited to Partner Lenders: Lendela can only show offers from its network, so borrowers might miss out on options from non-partner institutions.

- Not a Direct Lender: Lendela does not provide loans directly, meaning the final approval is still subject to the lender’s evaluation.

- Eligibility Requirements Apply: Some users may not qualify for certain offers if they don’t meet lender criteria.

- No Free Credit Monitoring: Unlike some competitors, Lendela doesn’t provide credit score checks or monitoring as part of the service.

Bottom Line

Overall, Lendela is a convenient and transparent platform for borrowers who want to compare multiple loan offers without the hassle of applying to each lender individually. While it has limitations, particularly in its lender network, its ease of use, speed, and transparency make it a strong choice for individuals seeking personal or business loans.

Tips for Getting the Best Loan Deal Through Lendela

Using Lendela can help you find competitive loan offers, but there are strategies to maximize your chances of securing the best deal. By preparing properly and comparing options carefully, you can save money and find terms that suit your financial situation.

Improving Your Credit Score

A higher credit score can significantly impact the interest rates and approval chances for loans on Lendela. Here are some practical steps to improve your credit profile:

- Pay Bills on Time: Late payments can negatively affect your score and reduce lender confidence.

- Reduce Existing Debt: Lowering your debt-to-income ratio can help you qualify for better loan terms.

- Avoid Multiple Applications: Applying for multiple loans at the same time may lower your credit score.

- Check Your Credit Report: Regularly review your credit report to correct any errors that could affect your score.

Comparing Offers Smartly

Once you receive multiple loan offers through Lendela, it’s important to compare them carefully, not just by interest rate. Consider the following:

- Total Repayment Amount: Look at the overall cost of the loan, including interest and fees.

- Repayment Terms: Shorter terms may have higher monthly payments but lower total interest.

- Additional Fees: Check for processing fees, prepayment penalties, or hidden charges.

- Lender Reputation: Choose lenders with good reviews and reliable customer service.

By combining a strong credit profile with careful comparison, you can use Lendela Review to secure a loan that offers both affordability and convenience.

Final Verdict

So, is Lendela Review worth using? For most borrowers, the answer is yes. Lendela Review simplifies the often confusing and time-consuming process of applying for loans by allowing users to submit a single application and compare multiple offers from trusted lenders. The platform provides transparency on interest rates, repayment terms, and fees, helping borrowers make informed financial decisions.

The main benefits of using Lendela Review include its convenience, speed, and wide range of lender options. While it doesn’t provide loans directly and is limited to partner lenders, its ease of use and ability to find competitive offers make it a valuable tool for anyone seeking personal or business financing.

For borrowers looking to save time, access multiple loan options in one place, and make smart financial choices, Lendela Review is a reliable and practical solution.

👉 Call to Action: Ready to find the best loan deal for your needs? Try Lendela Review for free and start comparing personalized loan offers today.

![Lendela Review [2025]](https://techwithaisha.com/wp-content/uploads/2025/09/hr-6-850x478.png)

1 thought on “Lendela Review [2025]: Find the Best Loan Deals Fast and Easy”

Comments are closed.